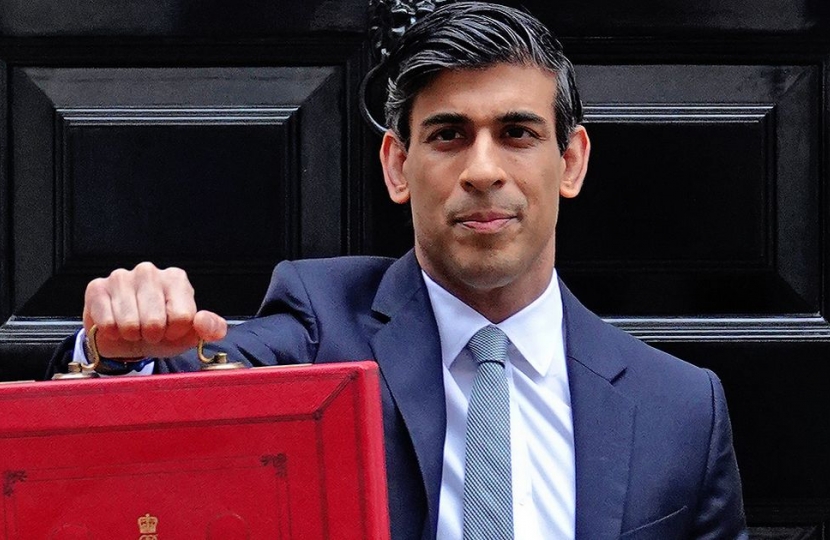

Earlier today, the Chancellor delivered his Autumn Budget and Spending Review where he set out the Government’s spending plans for each government department for the next three financial years.

The Chancellor’s Budget delivers post-Brexit tax reforms, tax cuts, and incentives to invest – plus major investment in infrastructure, research and development, skills, and new green industries. As the Chancellor said in the Commons Chamber, we are building a new economy post-Covid – an economy fit for a new age of optimism.

I think this is a really positive budget and a moment to reset. After the biggest recession in 300 years, the Chancellor’s Plan for Jobs will help us build back for the future and support our recovery from the pandemic. The economic data shows that indeed the economy is set for a very strong rebound.

Specific measures include:

- Significant tax cut for low-income families by reducing the Universal Credit taper rate from 63% to 55%.

- Raising the National Living Wage by 6.6% to £9.50, giving a £1,000 pay rise to 2m of the lowest paid.

- Freezing fuel duty for the twelfth year in a row, a £1.5 billion tax cut for motorists.

- Freezing alcohol duty and radically reforming the system to make it simpler, fairer and healthier.

- Cutting beer duty by 3 pence in a pint in a pub through our new Draught Relief.

- Increasing pay for public sector workers following a period of more targeted pay.

- Cutting business rates by 50% next year for 90% of retail, hospitality and leisure, and freezing all rates.

- Increasing total departmental spending by £150 billion by 2024: a 3.8 per cent annual real terms increase, the largest real terms increase this century, and record levels of capital investment not seen in 50 years.